- SOS Support Coordinators

- Gold Star Rememberance Days

-

- Survivor Outreach Services FactSheet :

- Education Benefits

Federal Student Aid

All survivors of Veterans are encouraged to apply for federal student aid. Survivors may receive loans, grants and work-study options to help pay for college or career school. To apply students must complete the free application for federal student aid (FAFSA).

Iraq and Afghanistan Service Grant

Students with a parent or guardian who died while serving in Iraq or Afghanistan after 9/11 may apply for an Iraq and Afghanistan Service Grant. To qualify, a student must have been under age 24 at the time of a parent’s or guardian’s death or enrolled in college or career school at least part time.

There is no application for the Iraq and Afghanistan Service Grant. The FAFSA will be compared with the file from the DOD, and the student will receive a letter explaining a potential increase in funding. Students must complete the FAFSA using their name as it appears in the Defense Enrollment Eligibility Reporting System (DEERS).

Veterans Affairs (VA) Education Benefits

VA education benefits are available to many survivors and dependents of veterans.

- There are two main VA education benefits available to survivors.

- The Marine Gunnery Sergeant John David Fry Scholarship (Fry Scholarship) is for children and spouses of services members who died in the line of duty after September 10, 2001.

- The Survivors’ and Dependents’ Educational Assistance (DEA) program offers education and training to qualified dependents of veterans who are permanently disabled because of a service-related condition or who died while on active duty.

For eligibility and program details, visit VA Survivor and Dependent Education Benefits.

Some survivors may be eligible for education benefits under the Post 9/11 Montgomery GI Bill. Eligible Soldiers may transfer their Post 9/11 Montgomery GI benefits to a spouse or dependent children.

- Visit VA Transfer of Post 9-11 GI Bill Benefits for information about transfer of eligibility.

- The VA has a dedicated phone line for GI bill beneficiaries of active-duty service members who died in the line of duty. Beneficiaries such as surviving spouses and children can call 1-888-442-4551 (option5) for assistance with education benefits. A trained agent with survivor benefits expertise will assist. Agents are available Monday–Friday from 7 a.m. to 5 p.m. CDT.

Other Types of Aid

Veterans service organizations, survivor groups and other local organizations provide opportunities for surviving family members. Contact an SOS coordinator for state, local and nonprofit resources.

- Finances and Survivor Benefits

Financial stability and security are an important part of supporting surviving Family members today and in the future. There are several resources for Families to help them adjust to financial changes and to plan wisely.

Beneficiary Financial Counseling Service (BFCS)

This service provides Servicemembers' Group Life Insurance beneficiaries with free advice from Financial Point, an independent company with a team of experts who handle many types of financial matters. Beneficiaries can access this service online 24/7 to request a financial plan. *Note: The service is available for two years from the date the claim is paid; it includes 40 hours of personal counseling and access to the program’s online resources. https://www.benefits.va.gov/insurance/bfcs.asp

Financial Readiness Program

This program provides general information about military benefits, spending plans, retirement, TSP, debt repayment, tax planning, identity theft, managing consumer credit, and consumer safety and rights. The Army’s personal financial counselors and managers (PFCs and PFMs) offer education. *Note: PFCs and PFMs cannot provide investment advice. To find a PFC or PFM, visit the Financial Readiness website: https://www.financialfrontline.org/.

HEART Act of 2008

The Heroes Earnings Assistance and Relief Tax Act of 2008 (HEART Act Public Law 110-245, §109) allows recipients of a death gratuity and/or SGLI to contribute all or part of the payments to a Roth IRA and/or a Coverdell Education Savings Account (CESA) without restrictions on contributions or distributions. Contributions must be made within one year of receiving the benefits. If you are the recipient of a death gratuity and/or the SGLI, you can protect and grow these assets for long-term financial security. For more information, read the HEART Act for Beneficiaries.

MilTax

Military life can make for tricky taxes. To help, the Defense Department offers MilTax software through Military OneSource. It takes into account deployments, combat and training pay, housing and rentals, multistate filings, living OCONUS and more. Visit the website for more details: https://www.militaryonesource.mil/financial-legal/tax-resource-center/miltax-military-tax-services/.

myPay

Survivors who receive annuity pay from the Defense Department can access myPay, the online pay management system for the DOD’s Defense Finance and Accounting Service (DFAS). MyPay provides convenient access to information about your payments and lets you easily update your account information and submit your annual certification. Those who provide an email address in myPay can receive important messages from the DFAS about their account and information from their loved one’s branch of service.

New to myPay?

There is a large menu of Frequently Asked Questions with answers on how to use myPay. You can browse more Frequently Asked Questions with answers or submit a question using AskDFAS. There are also helpful videos on using myPay.

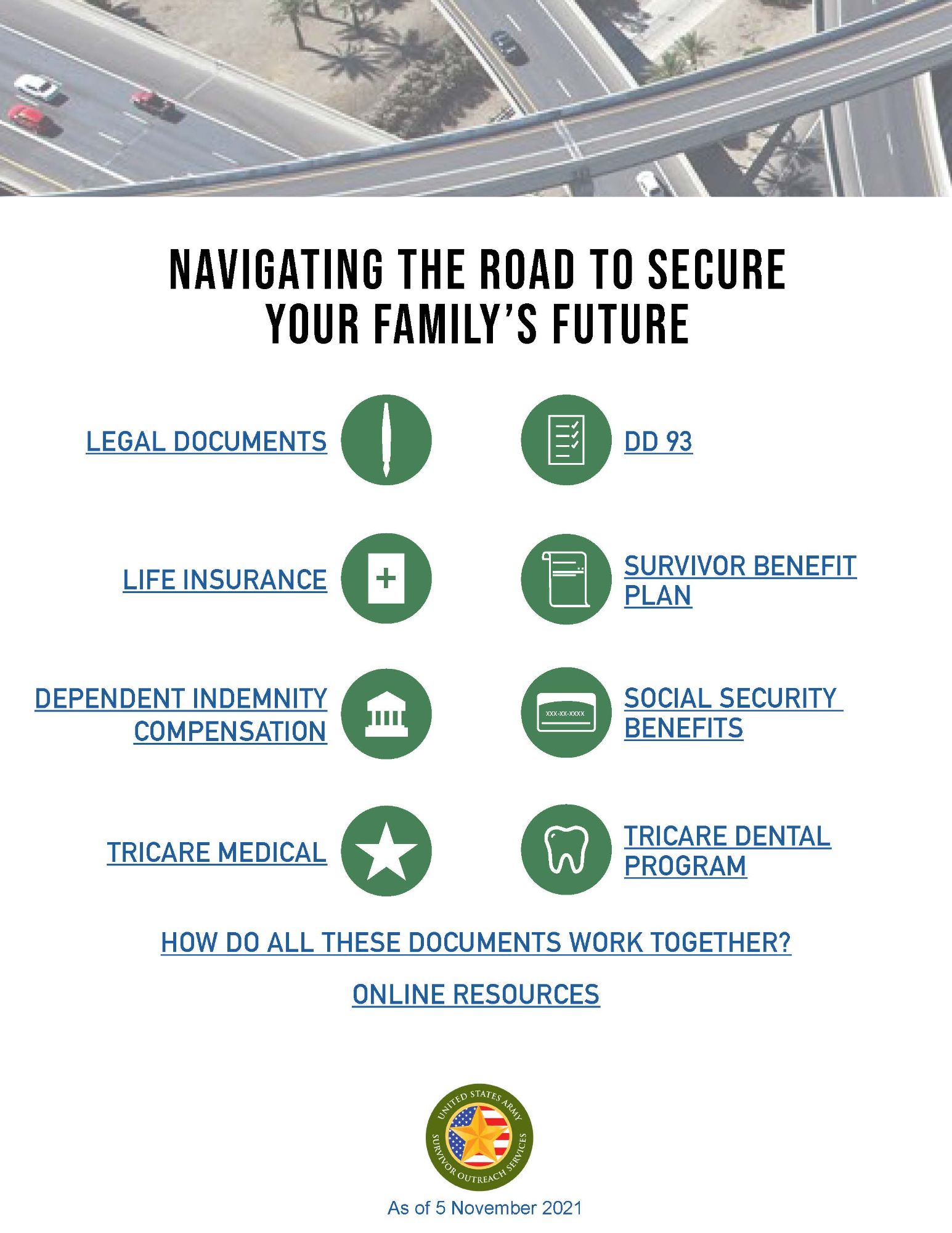

Survivor Benefit Plan

The Survivor Benefit Plan is a program the Defense Department sponsors and subsidizes that provides up to 55 percent of a service member’s retired pay to an eligible beneficiary after the member dies. The program provides no-cost automatic coverage to active-duty members and to reserve members who die of a service-connected cause while performing inactive-duty training. In addition, those on active duty can purchase coverage upon retirement, and reserve members can receive coverage when they have 20 years of qualifying service for reserve retirement pay.

Need information about the repeal of the SBP-DIC offset? Please see: SBP-DIC Offset Phased Elimination News.

- Resources

- Gold Star and Next of Kin Lapel Button

What is a Gold Star lapel pin?

The Army issues this pin to a widow or widower, to each of the parents, each child (natural or adoptive), stepchild, brother, half brother, sister and half sister of a service member who lost their life while serving in war or periods of armed hostilities, while engaged in military operations involving armed conflict with an opposing foreign force; while serving with friendly foreign forces engaged in an armed conflict in which the U.S. is not a belligerent party against an opposing armed force; while serving in a military operation outside the U.S. as part of a peacekeeping force; or who lost their life due to an international terrorist attack.

What is a Next of Kin lapel button?

The Army issues this button to each widow or widower, to each of the parents, each child (natural or adoptive), stepchild, brother, half brother, sister and half sister of a service member who lost their life while on active duty or while assigned in USAR or ARNG units in a drill status. The terms “widow” and “widower” include those who have since remarried; the term “parents” includes mother, father, stepmother, stepfather, adoptive mother or father, and foster parents who stood in loco parentis.

How do I get a replacement Gold Star lapel pin or Next of Kin lapel button?

Requests for replacements can be sent to the Army Human Resources Command; for instructions visit HRC Gold Star Lapel Buttons and next of Kin Lapel Buttons.

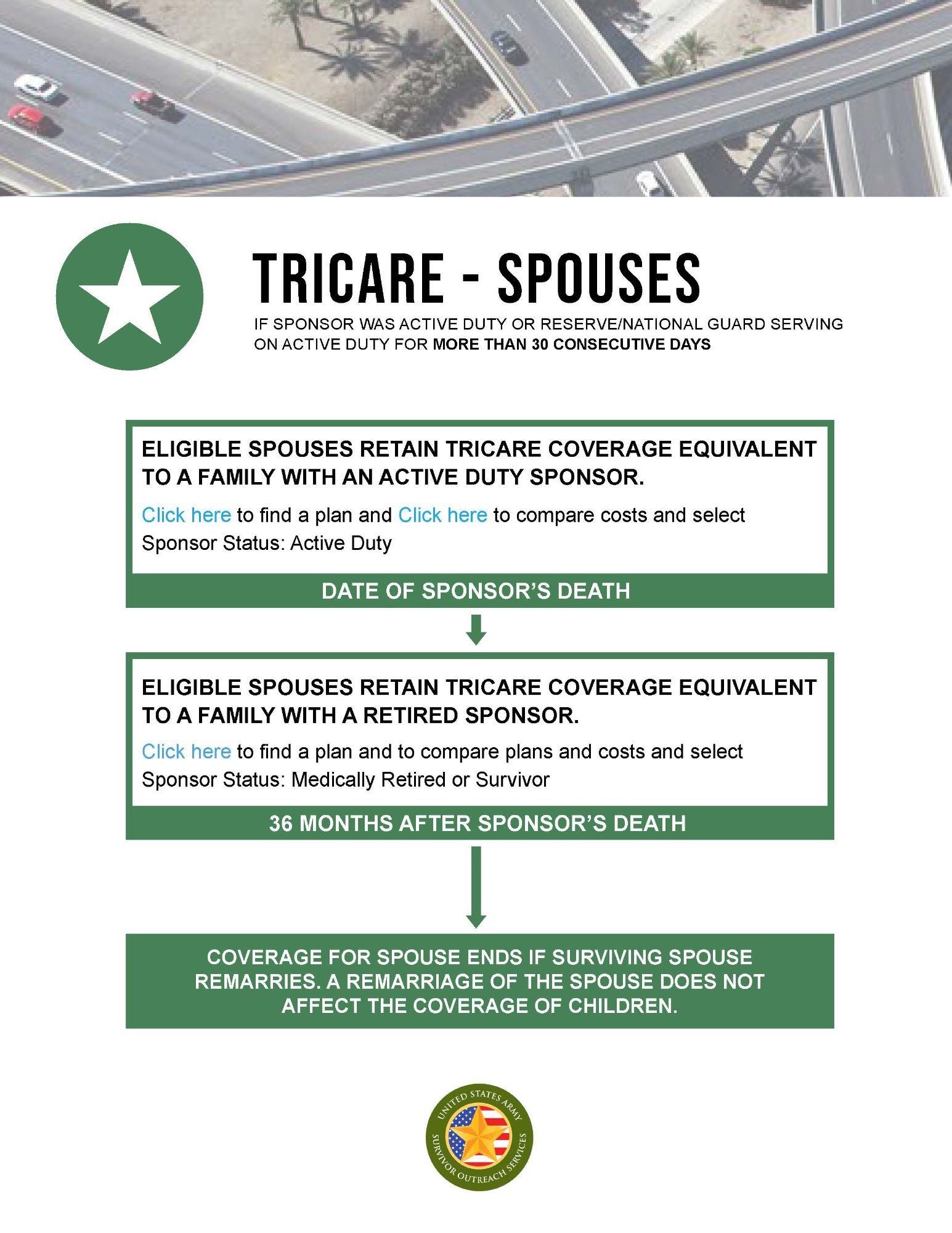

- Health Care Benefits

Factors may determine Tricare Health Care Coverage eligibility such as:

- The sponsor’s military status at death

- Whether the surviving family member is a spouse or child

Who is eligible for coverage?

The following scenarios provide an overview of survivor coverage:

- Survivors of Active-Duty Service Members

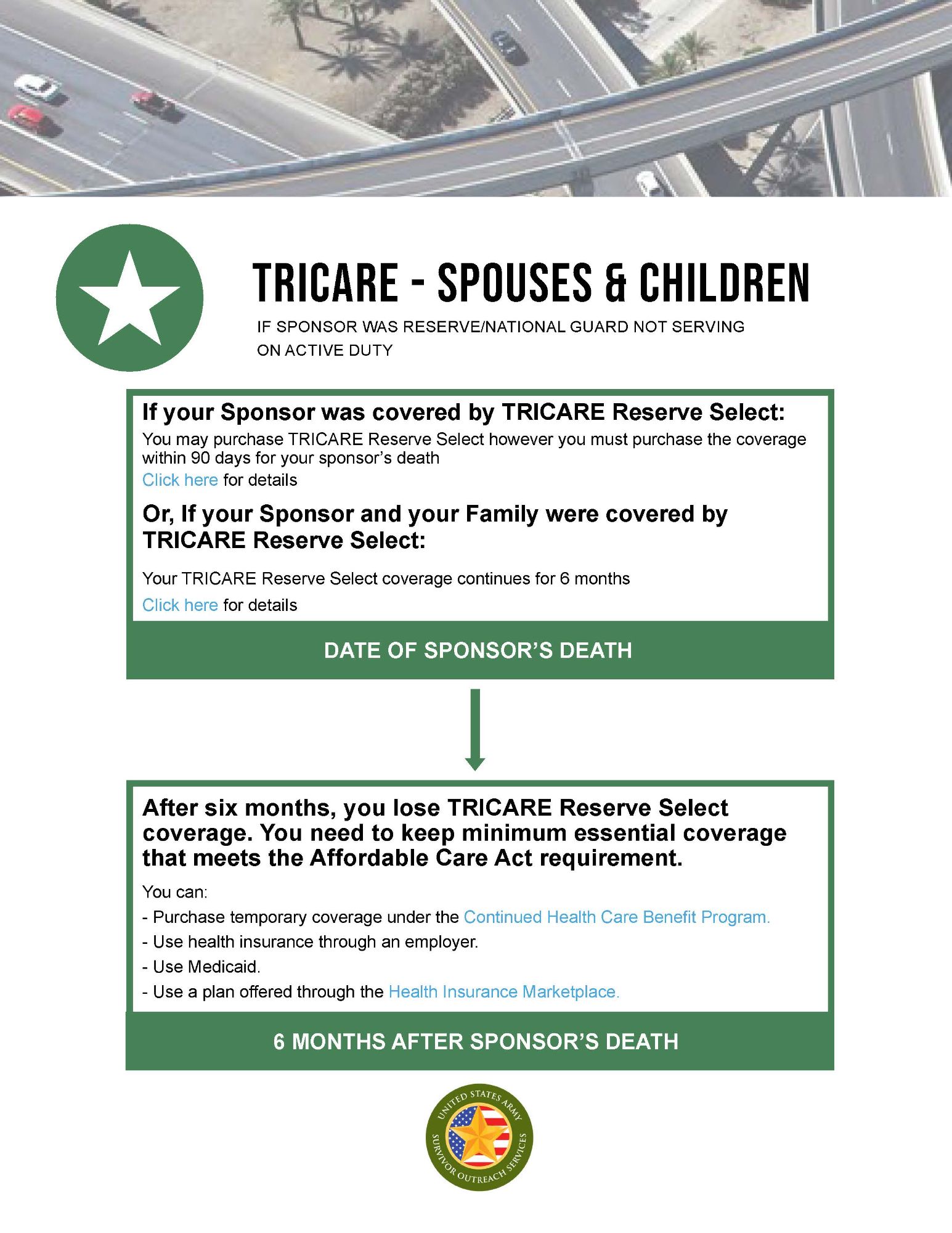

- Survivors of National Guard/Reserve Members

- Survivors of Retired Service Members

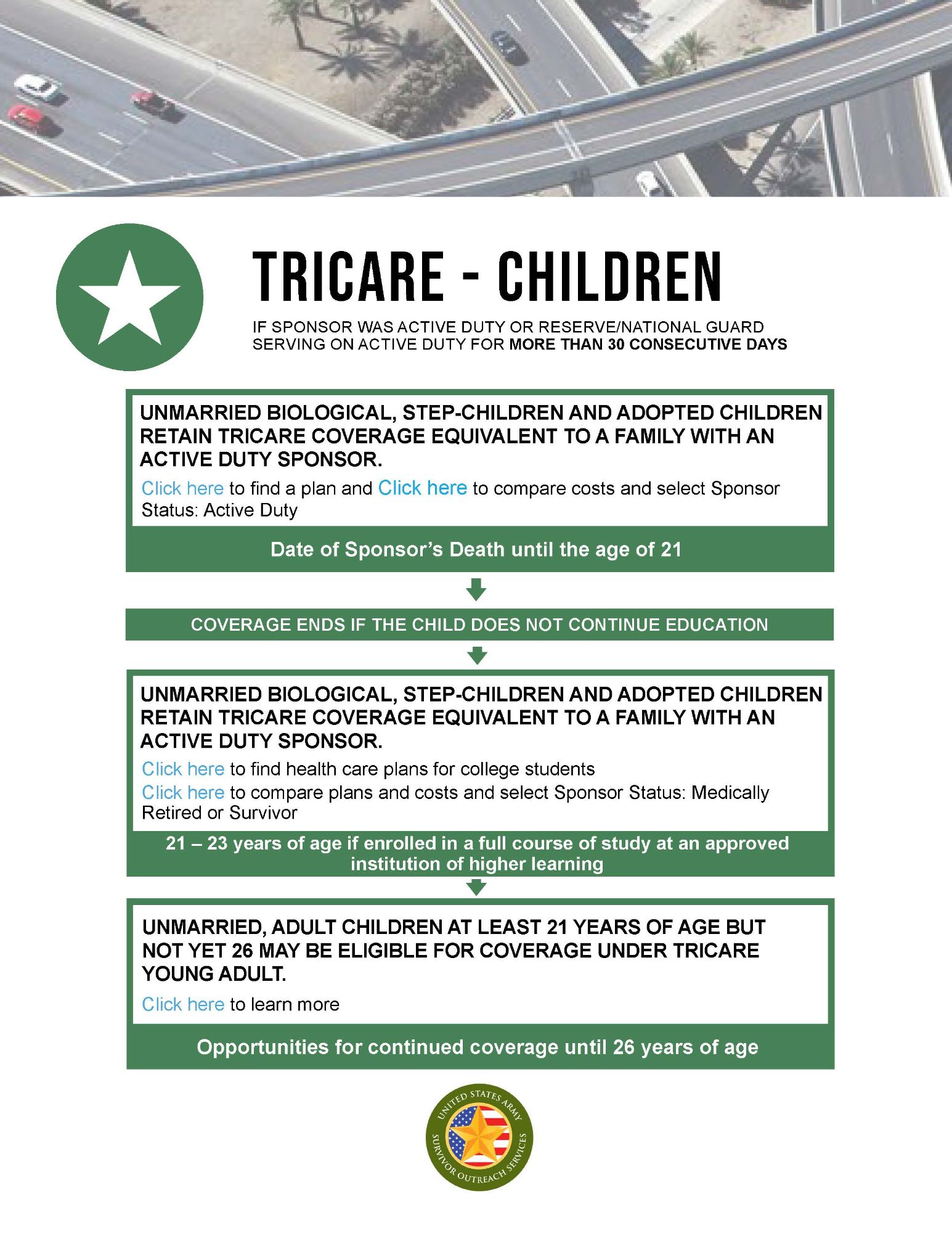

- Surviving Children who may qualify for TRICARE Young Adult

Spouses remain eligible unless they remarry.

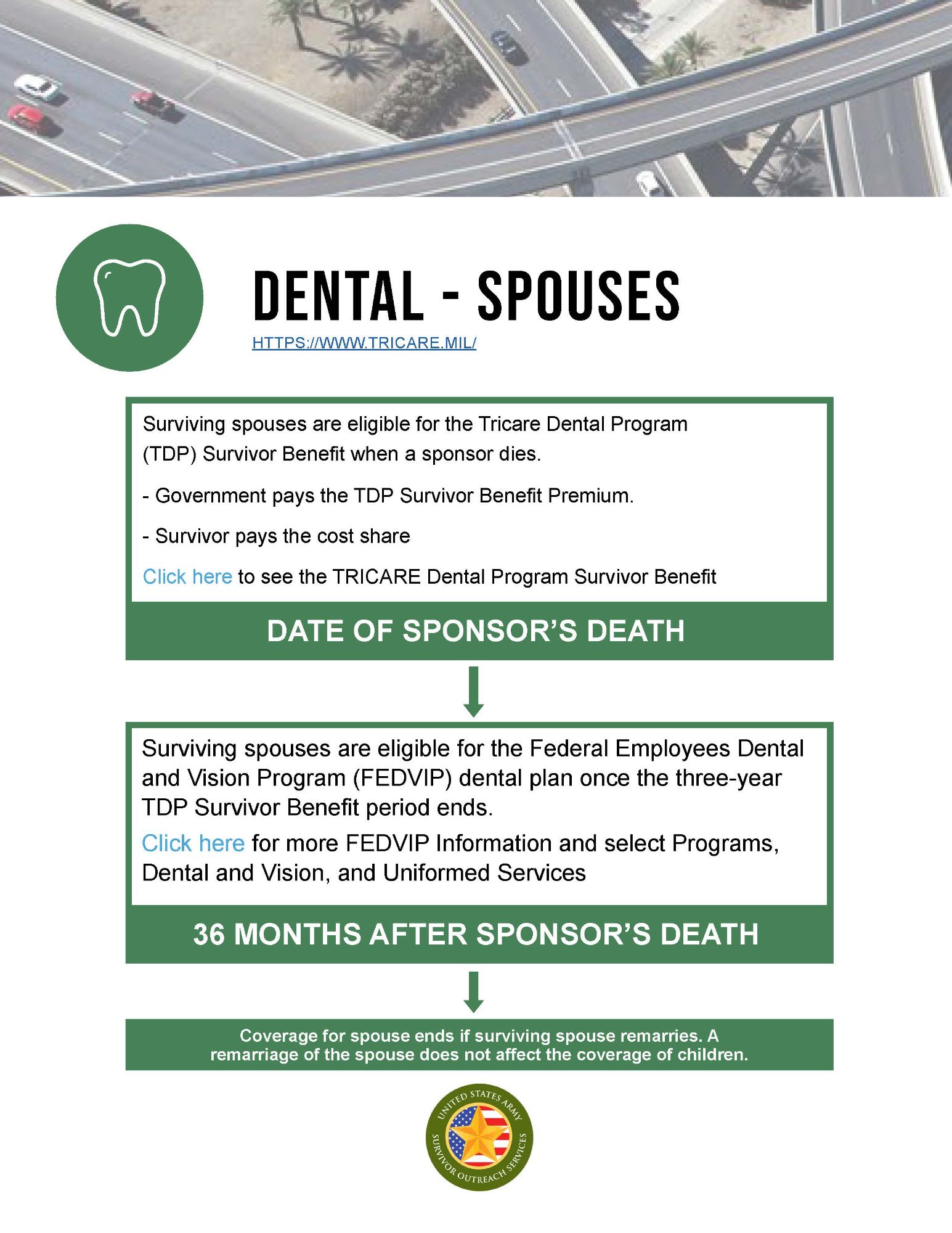

When does coverage change?

The coverage for surviving spouses changes to that of a retired family member after three years. The change is automatically reflected in DEERS. Surviving spouses will receive a letter from DEERS before the survivor status changes. This status change will affect health care options and out-of-pocket costs.

Coverage for children doesn't change—they are covered as active-duty Family members until they age out of TRICARE or lose eligibility for other reasons.

Visit the Tricare Plans and Eligibility page for more information.

- Housing and Moves

Military Housing

There are special housing benefit provisions for spouses and children of service members who die while serving. Eligible Family members living on base may continue to reside in base quarters for up to 365 days after the service member’s death.

Eligible Family members who do not live in government housing receive a housing allowance for up to 365 days after the service member's death.

Visit My Army Benefits or contact a survivor outreach coordinator for more information.

Moving

Surviving spouses must decide when and where to move. Different factors such as family support, student status or employment may affect that decision.

Spouses may relocate once at government expense. Eligible spouses must initiate the move by turning in household goods to the transportation office within one year after a loved one’s death. If a spouse is not ready to use the home of selection entitlement at one year, they may request an extension from the transportation office.

Extensions may be granted for up to six years. However, requests for extensions must be made yearly. Contact a survivor outreach coordinator or the transportation office at the installation nearest to you. Visit Military Installations and search for Household Goods to find a transportation office.

Visit Military One Source: The Final Move for more information.

- Installation Access

Eligible surviving spouses can have unescorted access to military installations so they can receive benefits they are entitled to by law or policy. Next of kin to a covered member of the Army may also access military installations in accordance with the National Defense Authorization Act (NDAA) of Fiscal Year (FY) 2018. See Section 626.

If eligible next of kin do not have a military ID card, they will need the Army Survivor Access Card. With this card, next of kin can access services and attend events and memorials. To get or renew a Survivor Access Card, complete the APPLICATION FOR SURVIVOR ACCESS CARD (IMCOM Form 44) and submit the form to a survivor outreach services coordinator. This is the first step to getting a card.

- Milestone Management

As an Army Survivor, you will encounter multiple milestones that will affect your benefits and entitlements. These are based on either a specified timeline, your age or marital status. The team at Army Survivor Outreach Services encourages you to familiarize yourself with the milestones before they occur so that you can prepare your Family. You can use our Navigating Survivor Milestones guide to see the upcoming changes or look at the guides on specific benefits and entitlements. For more information, contact your Survivor Outreach Services coordinator.

- Navigating Survivor Milestones

- Child Turning 18 - Milestone Guide

- Child Turning 21 - Milestone Guide

- Final Move - Home of Selection - Milestone Guide

- SBP Certificate of Eligibility - Milestone Guide

- Social Security Survivor Benefits - Milestone Guide

- Spouse Year 3 TRICARE Change - Milestone Guide

- TRICARE For Life - Milestone Guide

- VA DIC Transitional Benefit - Milestone Guide

- Army Retiree Widow Checklist

Army Retiree Check List for Survivors

This checklist is designed to help you and your loved ones with knowledge and information that may prove helpful. While it may be impossible to truly prepare for the overwhelming emotions and dilemmas that arise with the loss of a loved one, it does help when most of the below issues have been put into place.

_Create a military file that includes your retirement orders, separation papers, DD-214, medical records, etc. Make sure your spouse knows the location and telephone number of the nearest military installation.

__ Create a military retired pay file that includes the pertinent information for DFAS and Army Personnel Command:

Defense Finance and Accounting Service

U S Military Retirement Pay

Post Office Box 7130

London, KY 40742 7130

(800) 321-1080 or (216) 522-5955/800) 269-5170 (for deceased members)

DEPARTMENT OF THE ARMY

Retirement Services Office

200 Stovall St.

Alexandria, VA. 22332-0470

(703) 325-9158

This file should also include the number of any VA claim still pending and the address of the VA office being used; a list of deductions currently being made from benefits; and the name, relationship and address of the person you have made the beneficiary of any unpaid retired pay at the time of death.

__ Create an annuities file. This file should have information about the Survivor Benefit

Plan (SBP), Reserve Component Survivor Benefit Plan (RCSBP) or the Retired

Serviceman’s Family Protection Plan (RSFPP), Civil Service annuity, etc. Additional information regarding SBP annuity claims can be obtained from the DFAS-Cleveland office at 1-800-321-1080.

__ Create a personal document file that has copies of your Will, marriage certificates, divorce decrees, adoptions and naturalization papers.

__ Create an income tax file Include copies of your state and federal income tax returns.

__ Create a property tax file Include copies of tax bills, deeds and any other related information.

_ Create an insurance policy file Include life, property, accident, liability and hospitalization policies.

__ In a secure location, maintain a list of all bank accounts (joint or individual). Include the location of all deposit boxes, savings bonds, stocks, bonds and any securities owned.

__ In a secure location, maintain a list of all charge accounts and credit cards Include account numbers and mailing addresses.

__ Maintain a list of all associations and organizations of which you are a member. Some of them could be helpful to your spouse.

__ Maintain a list of all friends and business associates who may be helpful. Include name, address and phone number.

__ Spend time with your spouse discussing your plans with respect to the type and place of your funeral service. You should decide which cemetery, whether ground burial, or cremation, whether or not you want Military Funeral Honors, etc. If your spouse knows your desires, it will resolve some of the questions that might arise at a later date.

_Visit a local funeral home and pre-arrange your services. Many states will allow you to pre-pay for services.

__ Investigate the decisions that you and your family have agreed upon. Many states have specific laws and guidelines regulating cremation and burials at sea. Some states require a letter of authority signed by the deceased in order to authorize a cremation. Know the laws in your specific area and how they may affect your decisions.

Once your decisions have been made and you’re comfortable with them, have a will drawn up outlining all your wishes. Insure that your Will and all other official documents are maintained in a secure location known by your loved ones. This includes all of your DD-214s or Retirement Orders

Who should be notified in the event of my death?

1. Defense Finance and Accounting Service – (800) 321-1080 or (216) 522-5955 or (800) 321-1080 Fax: (800) 469-6559

2. Social Security Administration (for death benefits) - (800) 772-1213

3. Department of Veterans Affairs (if applicable) – (800) 827-1000

4. Office of Personnel and Management (OPM) (if applicable) (724) 794-8690

5. Any fraternal groups that you have membership with: e.g., MOAA, FRA, NCOA,VFW, AL, TREA

6. Any previous employers that provide pension or benefits.

7. Funeral home and Military Funeral Honors.

The above information is not all-inclusive and should be used with other estate planning tools to lessen trauma to your loved ones. If you have other suggestions that might prove helpful and would like to share them with your fellow retirees, send them to your Retired Services Office.

DEPARTMENT OF THE ARMY

Retirement Services Office

200 Stovall St.

Alexandria, VA 22332-0470

(703)325-9158

***Please know that this is a basic military checklist. You should include in yourpackage all civilian related information not cited above that would assist your beneficiaries in carrying out your last will.

RETIREMENT SERVICES FORT DRUM

Clark Hall, Bldg 10720 Room A1-21

Fort Drum, NY 13602

Office: (315) 772-6434/6339

Fax: (315) 772-388

Who should be notified in the event of Army retiree death?

- Contact your local casulty assistance office (CAC) to report the death.

- Defense Finance and Accounting Service - 800-321-1080 or 216-522-5955/800-269-5170

- Social Security Administration (for death benefits) - 800-772-1213

- Office of Personnel and Management (OPM) (for Federal Employees) - 888-767-6738

- Any fraternal group that you have membership with: e.g., MOAA, FRA, NCOA, VFW, AL, TREA

- Any previous employers that provide pension or benefits.

- Department of Veterans Affairs (if applicable) - 800-827-1000

- Burial at Sea information - 866-787-0081

- Sister Service Survivor Care Contact

Services

These survivor advocates are available to provide support and address issues or concerns by spouses and other dependents of deceased service members regarding casualty assistance or receipt of military survivor benefits authorized by law.

Other Service Gold Star and Surviving Family Member Representatives:

U.S. Navy

Long Term Assistance Program

Phone number: (901) 874-0083U.S. Army

Family Programs Directorate

Phone number: (210) 466-1173

Click to emailU.S. Air Force

Airman and Family Care Division

Phone number: (703) 693-0683

Click to emailU.S. Coast Guard

Coast Guard Casualty Matters Office

Phone number: (703) 872-6647Learn More

If you are a survivor and not satisfied with the casualty assistance provided by your service, contact your Gold Star and Surviving Family Member Representative. They are there to help, regardless of how and where your loved one died.

Personnel eligible to participate include the widow, parents and the next of kin. The term "widow" includes widower ; the term "parents" includes mother, father, stepmother, stepfather, mother through adoption, father through adoption, and foster parents who stood in loco parentis; the term "next of kin" only includes children, brothers, sisters, half-brothers, and half-sisters; and the term "children" includes stepchildren and children through adoption.

U.S. Marine Corps

Gold Star and Surviving Family Member Representatives

(703) 784-9580

Gold.Star.Advocate@usmc.mil

- Survivor Link Newsletter

The Survivor Link newsletter is published every quarter to provide information about benefits changes, program updates and opportunities to connect with other survivors. To subscribe just follow the link below. You can have the newsletter delivered to your email address or as a text message to your phone. Subscribe here.

- Symbols of Honor: Blue Star and Gold Star Service Flags

The Blue Star Service Flag

Blue Star Service Flag: Patented by retired Army CPT Robert Queissner in 1917, the Service Flag, also known as a Blue Star Flag or Service Banner, represents a family member serving in the Armed Forces during a time of conflict.

The Gold Star Service Flag

The Gold Star Service Flag: Created in 1918 after President Woodrow Wilson approved a suggestion allowing mothers who lost a child serving in the war to wear a gold gilt star on the traditional black mourning arm band.

Service Flags were officially authorized by Congressional Act 36 U.S.C. 179-182 (1967), the Service Banners are usually displayed in a window of a home where an immediate Family member of a service member resides. Service flags may be displayed for the duration of the conflict.

SOS Mission: Build a unified program which embraces and reassures Survivors that they will be continually linked to the Army Family for as long as they desire.

SOS Purpose: The Army SOS Program ensures a seamless transition from the initial support provided by the Army’s Casualty and Mortuary Affairs Operations Division (CMAOD) to long-term, ongoing referral assistance for eligible survivors. Services are portable and, where available, may be provided at an Army location (including joint installations, ARNG installations or State headquarters, and USAR centers) closest to the survivor’s current residence.

SOS Support Coordinators are the Surviving Families link to finding resources and answers that work best for them. They can assist Survivors to obtain copies of documents, navigate local, state, and federal agencies. They can also connect Survivors with local and national support groups and bereavement resources. They also provide information and referral on a wide range of other topics.

The SOS Program connects you with people who can help . Our services include grief counseling, financial counseling, benefits coordination, support groups, peer to peer support and information about garrison and surrounding events.

Say Connected: For up-to-date information, remembrances, and events; follow us on Facebook: Fort Carson ACS SOS