- Financial Readiness Program (FRP). FRP provides comprehensive educational and counseling programs in personal financial readiness. The program covers indebtedness, consumer advocacy and protection, money management, credit, financial planning, insurance, and consumer issues. Other services offered include mandatory financial literacy, financial planning for transitioning Soldiers, financial counseling for deployed Soldiers and their Families, and the Department of Defense Family Subsistence Supplemental Allowance Program.

- Army Emergency Relief (AER). AER is the US Army's own nonprofit organization dedicated to alleviating financial distress in the force. AER provides grants and zero-interest loans to active-duty and retired Soldiers and their Families. AER has supported over 4 million Soldiers since 1942. AER offices are conveniently located at installations around the world. Visit ArmyEmergencyRelief.org to learn more.

- Online Support and Education. Go to Financial Frontline for self-service financial literacy education and help.

- Blended Retirement System. The Blended Retirement System (BRS) combines elements of the legacy retirement system with benefits similar to those offered in many civilian 401(k) plans. Get smart on retirement benefits with the Army Retirement Services Office and Joint Knowledge Online Training.

- Financial Readiness Affiliates

- Thrift Savings Plan (TSP). The TSP is a federal government-sponsored retirement savings and investment plan available to both federal civilian employees and members of the uniformed services. The TSP offers the same type of savings and tax benefits that many private corporations offer their employees under 401(k) plans. The retirement income a TSP account provides will depend on working-year contributions and the earnings on those contributions. Learn more at the official Thrift Savings Plan website.

- Consumer Financial Protection Bureau (CFPB). The CFPB makes markets for consumer financial products and services work for Americans — whether they are applying for a mortgage, choosing among credit cards, or using any number of other consumer financial products. The CFPB gives consumers the information they need to understand the terms of their agreements with financial companies. Learn more about the CFPB, visit the CFPB on-demand forum and tools website, or order free CFPB publications.

- Better Business Bureau (BBB) Military Line. The BBB Military Line provides free resources to our military communities in the areas of financial literacy and consumer protection through the efforts of 112 BBBs across the US. Visit the BBB Military Line to learn more.

- COVID-19 Financial Resources

-

Economic Relief

- IRS Tax Relief

- Stimulus Check

- Unemployment Benefits

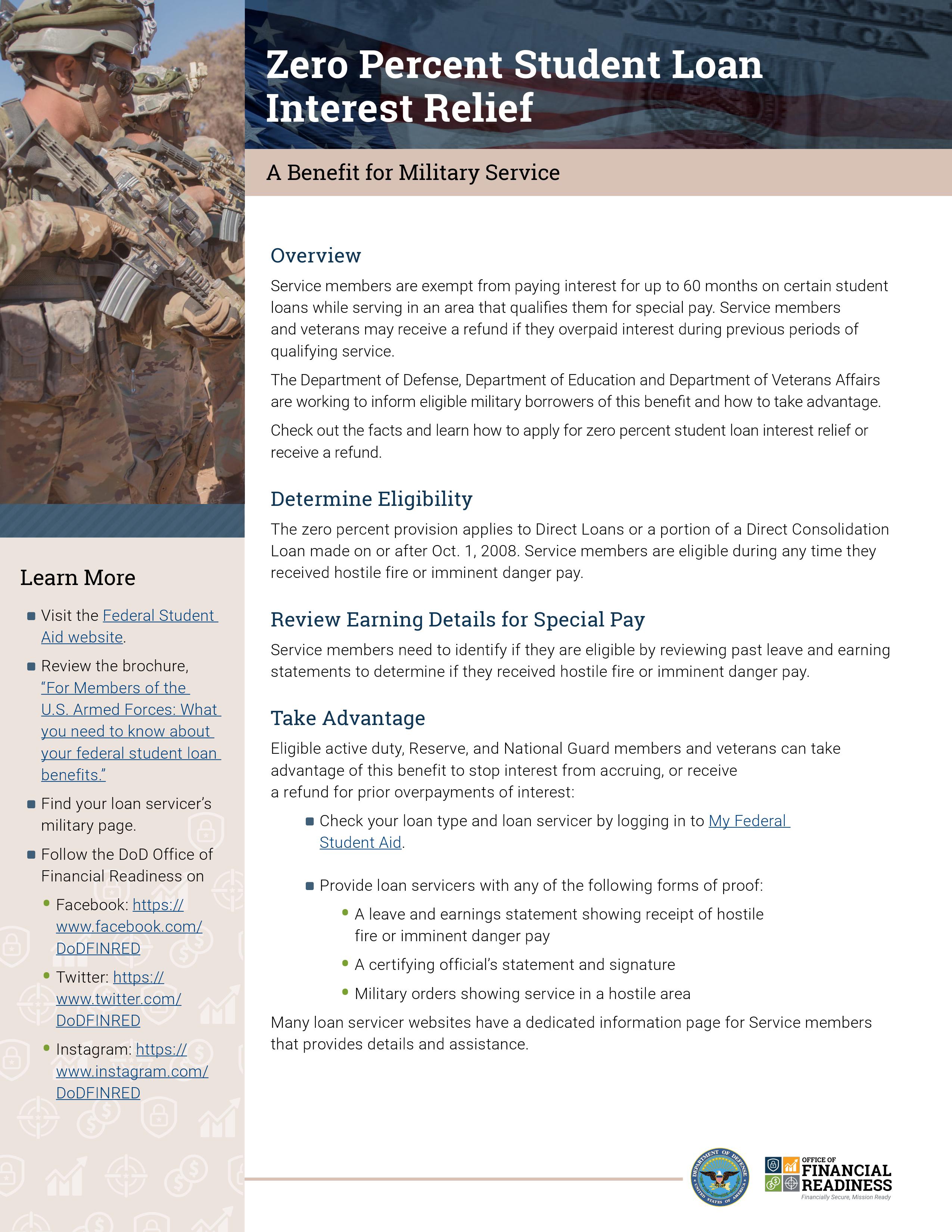

- Federal Student Aid - Forbearance Info for Students, Borrowers, and Parents

Financial Assistance

- Fort Carson Army Emergency Relief

- Military Hardship Pay for Troops in Quarantine

- The Pentagon Federal Credit Union Foundation

- Pikes Peak United Way Emergency Relief Fund

- Wounded Warrior Project Emergency Financial Assistance

Rent / Mortgage Relief

Monthly Bills and Utilities

- Federal Communications Commission’s list of companies and associations who have pledged not to terminate services, waive late fees and open Wifi hotspots

- Comcast will provide 60 days of free internet to new families

- CenturyLink will waive late fees and will not terminate residential or small business customer’s service for the next 60 days due to financial circumstances associated with COVID-19

- Colorado Springs Utilities will not disconnect water, sewer, or natural gas services over the inability to pay bills during the COVID-19 pandemic. Contact Colorado Springs Utilities customer service to be placed on payment plan (719-448-4800) or visit www.csu.org to make payments or request support.

Local / Online Resources

- Mission 22 Financial Resources for Veterans

- Military Saves Resources for Military Families

- Colorado PEAK - Public assistance programs

- Government Emergency Financial Assistance After a Disaster

- American Red Cross

- Department of Defense - Office of Financial Readiness :)

- Frequently Asked Questions (FAQs)

-

What is Army Emergency Relief and how can I apply?

Army Emergency Relief is a non-profit organization that provides financial assistance in an unforeseen emergency situation to Active Duty Soldiers, Family Members, Retiree, Retiree’s Family Members, Widows and Widowers. The assistance is provided as a loan, grant or a combination of both. Application maybe submitted on line. For more information, please contact Army Emergency Relief at telephone number (719)526-4783.

Can I get assistance with first month rent or my initial deposit?

For any AER assistance case, it always begins with an application. Here is a direct link to the fillable Fort Carson AER packet: https://carson.armymwr.com/download_file/67312/19773. We also have a video explaining how to fill out the application on our AER website: https://carson.armymwr.com/programs/army-emergency-relief-aer

We will also need supporting documentation with an application. For the case above, we need an official print out from the landlord or property management company showing the move in costs, a copy of the latest end of month leave and earnings statement (LES), and complete all the documents in the application packet (AER 101, Budget, & AER 575).

My spouse had to quit her job and hasn't found anything additional but our moving expenses are much higher than we expected and now we don't have money for furniture?

AER does provide assistance with basic furniture when a Soldier is establishing their first house hold, a single Soldier authorized to move out of the barracks, or to replace items lost in a fire or natural disaster. Many times there are situations that we cannot assist with, but the underlying event could cause a financial hardship with other categories that we can assist with. If there is a financial emergency, we can get the process started with the AER packet: https://carson.armymwr.com/download_file/67312/19773 and begin to gather supporting documents for the AER request.

How much of my monthly income should go towards my rent?

There are many different ratios for housing costs which vary from each person’s own situation but the three most popular are 25%, 28%, & 36% ratios. The 28% and the 36% can be seen when purchasing a house as these are banking standards for reviewing an individual/couples total debt. Check out the Fort Carson Mortgage Qualification worksheet at: https://carson.armymwr.com/download_file/70955/11643

Every location has a different cost of living and many times rent may be outside of this range but a good rule to stick to is: never pay more than the BAH rate, to include utilities. This way, when PCSing, we won’t run into financial problems due to relying on extra income from BAH. Imagine PCSing from Colorado, which an E4 BAH is currently $1,774, to Fort Hood which is $1,149.

We should try to play it safe and stay within 25% of gross (total) income to be used for housing (rent, utilities, insurance, etc.) Let’s look at a married E-4 in Colorado.

Gross Income: $4,655.81 Monthly ($55,869.72 Yearly)

Base Pay: $2,507.10

BAS: $372.71

BAH: $1,776.00

Housing Ratio Gross Pay * .25 (25/100 = 25%)

25% $4,655.81 * .25 = $1,163.95

Front End Gross Pay * .28 (28/100 = 28%)

Ratio $4,655.81 * .28 = $1,303.63

Back End Gross Pay * .36 (36/100 = 36%)

Ratio $4,655.81 * .36 = $1,676.09

When we lower our expenses, there is more money to put towards other debts, goals, savings, and our future!

I just signed a rent agreement two months ago and now found out I have to deploy?

Here is information from the Servicemembers Civil Relief Act located on justice.gov.

Section 3955 of the SCRA, 50 U.S.C. § 3955, addresses the topic of lease terminations. With respect to residential apartment leases, the SCRA requires that the premises be occupied (or are intended to be occupied) by a servicemember or a servicemember’s dependent(s). 50 U.S.C. § 3955(b)(1). Additionally, the lease must either be executed by a person who later enters military service, or is in military service and later receives permanent change of station (“PCS”) orders or deployment orders for a period of at least 90 days. Id. at § 3955(a)(1). To terminate a residential lease, the Soldier must submit a written notice and a copy of his or her military orders – or a letter from a commanding officer – by certain methods to the landlord or landlord’s agent. Id. at § 3955(c) & (i)(1). If a servicemember pays rent on a monthly basis, once he or she gives proper notice and a copy of his or her military orders, then the lease will terminate 30 days after the next rent payment is due. 50 U.S.C. § 3955(d)(1). If a servicemember lessee dies while in military service, the spouse of a lessee may terminate the lease within one year of the death. Id. at § 3955(a)(3).

In order to stay protect we need to mail your written notice as a certified letter with return receipt which will give us documentation of when you notified your landlord.

I'm still at my old duty station but I found a house that I could rent, can AER assistance help prior to me getting there?

Be very wary if you are renting sight unseen. Watch out for some of these likely signs of a scam:

I was told to wire money

This is the surest sign of a scam. There’s never a good reason to wire money to pay a security deposit, application fee, first month’s rent, or vacation rental fee. That’s true even if the scammers send you a contract first. Wiring money is the same as sending cash, once you send it, you have no way to get it back.

I was told I need a security deposit or first month’s rent before we have met or sign a lease

It’s never a good idea to send money to someone that we never met in person for an apartment we haven’t seen. If we can’t visit an apartment or house in person, ask someone we trust to go and confirm that it’s for rent, and that it is what was advertised. In addition to setting up a meeting, do a search on the owner and listing. If you find the same ad listed under a different name, that’s a clue this may be a scam.

They told me they’re out of the country

But they have a plan to get the keys into our hands. It might involve a lawyer or an “agent” working on their behalf. Some scammers even create fake keys. Don’t send money to them overseas. If we can’t meet in person, see the apartment, or sign a lease before we pay, keep looking. What if the rental itself is overseas? Paying with a credit card or through a reputable vacation rental website with its own payment system are your safest bets.

https://www.consumer.ftc.gov/articles/0079-rental-listing-scams

As a Newcomer, just arriving to Fort Carson, how may I receive food assistance?

You may contact Army Community Service Financial Counselors for assistance with food. Assistance maybe provided by Army Emergency Gift Certificates, Emergency Food Banks or applying for Army Emergency Relief Assistance. Please contact Army community Service, Financial Readiness Program for further information at 719-526-4601.

Can I get assistance for hotel lodging until I find a place to live and if so who can assist me?

Please contact Army Community Service, Financial Readiness Program at www.carson.army.mil/acs and call 719-526-4601/526-4783 for assistance.

How can I apply for emergency financial assistance after normal duty hours?

If Army Emergency Relief assistance is needed after normal duty hours or on the weekends, holidays, please contact American Red Cross at telephone number 1-877-272-7337.

Am I getting paid correctly? LES Questions?

Talking to your leadership, S1, and Finance can help you fix any pay issues. Coming from different locations you may see that Colorado or Conus duty stations do not get COLA or additional entitlements. Please consider Army Community Service Financial Counselor(s) to sit down with you and review your LES, check military pay tables, as well as BAH rates to see if you are being paid correctly.

Why am I (still) living paycheck to paycheck?

Avoiding lifestyle inflation is difficulty and we want to make sure we are using our paycheck as efficient as possible. I would recommend to download the FRP budget worksheet let’s analyze our living expenses and debt expenses versus income. Let's get our expenses and income on paper to see where the money is being utilized monthly so we can start setting ourselves up for success and working towards the future we want!

I feel trapped and overwhelmed with debt, what can I do? Should I file for bankruptcy?

Debt can be destructive to our finances and it is the reason why we need to make a change to our lifestyles and begin paying it down little by little. One of the most effective ways to pay off debt is the debt snowball or avalanche method. Download the Financial Readiness Debt Reduction Calculator and come in to talk to a Financial Counselor so that we can become debt free together.

I have some collection accounts in my name and debt collectors keep calling me, what should I do?

First, don’t panic. Let’s work together and make contact with these agencies by having them (the collection company) validate the debt. Contact the Financial Counselors at ACS and we have sample templates that we can use in order to start clearing up these collections accounts. Once the debt(s) are validated we start the negotiation process together.

I am not sure if I have a credit score or what items are on my credit report?

By law we are allowed to check our credit reports for free at www.annualcreditreport.com. It is a good habit to at least check one report every four months so that we can monitor the information for accuracy and catch any errors or possible breaches to our credit within a reasonable time. An ACS Financial Counselor can work with you in order to navigate the process and explain the information on your credit report.

What’s a good score? How do I improve my Score?

If you do not have a credit score of 700 or better (remember the FICO score goes from a low 300 to a maximum 850) come make an appointment and lets tweak our habits so that during your time at Fort Carson we can try our best to get above the 700 mark. The best way to build credit is to identify a small recurring budget item (Netflix, cellphone, etc.) that we pay with our no fee credit card and set up an automatic payment(s) to pay the balance off in full every month.

Why is investing important? How do I get started?

Imagine twenty or thirty years from now what you will be doing and where you will be living. There will be a point in time when we chose not to work and we will still need to have income to provide for our lifestyle. Investing is a way that we can consistently put money away each month and slowly build wealth by investing or buying companies (stocks) and/or loans (bonds). They best and easiest way is to participate in your employer’s 401(k) plan which is the Thrift Savings Plan(TSP).

How do I set up the TSP and where is my money going?

To determine how much of your paycheck is going to your TSP account we will need to log into mypay.dfas.mil to check this amount. This money then goes into your investment account which we can view at www.tsp.gov. This can be somewhat overwhelming, so please make a one on one financial appointment with a Financial Counselor at Army Community Service to review the process and discuss your investment options.

- Should I be investing right now?

-

In these turbulent times it can be very stressful and we tend to let our emotions get the best of us. I wanted to remind you of the Bogleheads Investment Philosophy:

1. Develop a workable plan

2. Invest early and often

3. Never bear too much or too little risk

4. Never try to time the market

5. Use index funds when possible

6. Keep costs low

7. Diversify

8. Minimize taxes

9. Keep it simple

10. Stay the course

- Arrival at First Duty Station

-

- Soldiers Welcome Brief

- Understand Your Benefits

- Start Planning for Your PCS or ETS

- Set Up Your 3 Year Goals

- Establish / Build Up Your Emergency Fund

- Take Advantage of Free Education and Seminars

- Vesting in Your Thrift Savings Plan

-

- Understand your Retirement Options

- Blended Retirement

- Retirement Pension

- Learn about Compound Interest

- Maximize Contributions

- Understand Your Investment Options (G,F,C,S,I, & Lifecycle Funds)

- Promotions

-

- Review Your Budget

- Maximize Savings

- Avoid Lifestyle Inflation

- Minimize Debt

- Refocus and Update Your Goals

- Work On Credit Score

- Review TSP Contributions and Investment Funds

- Life Events

-

- Marriage

- Birth & Adoption

- Divorce

- Disabling Condition

- Death

- Deployments

-

- Update Paperwork and Insurance Policies

- Consider Freezing Your Credit Report

- Set Up Credit Alerts

- Review and Update Your Budget

- Increase Savings

- Understand Pay Allowances and Entitlements

- Sit Down and Meet with a Financial Counselor at ACS

- Career Transition

-

- Examine Your Goals, Budget, and Savings

- Attend Transition Assistance Program

- Make Appointment with Retirement Service Office

- Make Appointment with Education Center

- Learn about Your VA Benefits

- Sit Down with an ACS Financial Counselor

- Stay in the know on current financial topics!

-

News from the CFPB

- Financial Resources for Military

-

Helpful financial readiness links include:

- Thrift Savings Plan: A Federal Government-sponsored long-term retirement savings and investment plan, available for both Federal civilian employees and members of the uniformed services.

- U.S. Savings Bonds: A shorter-term savings option with competitive interest rates and backed by the full faith and credit of the United States.

- Office of Financial Readiness: You will find resources, education and support for every stage of financial readiness — whether you’re just getting started learning about finances, interested in tweaking your current plan, or ready to jump in with both feet. Our goal is to foster a financially secure and mission-ready force with every military family living their best life today and in the future.

- Military OneSource: A Department of Defense-funded program that provides comprehensive information on every aspect of military life at no cost to active duty, National Guard, reserve members, and their Families.

- Office of Servicemember Affairs: A component of the Consumer Financial Protection Bureau helps to educate and empower military members, veterans, and their Families in the consumer financial marketplace.

- Saveandinvest.org: A project of the FINRA Investor Education Foundation, a free, unbiased resource dedicated to your financial health. Helps you make informed decisions through easy-to-use tools and resources, and arms you with the information you need to protect yourself from investment fraud.

- On Your Own: Money. Life. Future.

- Military Consumer Guide

- Sign Up for Classes and Make Appointments

-

Click here to register for all of our FREE classes.

To schedule appointments please call us at (719) 526-4605.

Want to take charge of your finances? The Army's Financial Readiness Program (FRP) and Consumer Advocacy Services can help with comprehensive educational and counseling programs. Learn about debt, consumer advocacy and protection, money management, credit, financial planning, insurance, and consumer issues. Through classroom training and individual counseling, participants can learn how to save and invest money, establish savings goals, eliminate debt, and save for emergencies.

We offer:

Here are some other financial resources for Soldiers and their Families:

(Government Links)

(Non-Government Links, No Endorsement Implied)

If you are looking for Army Emergency Relief please click HERE

CLICK HERE TO VIEW THE FINANCIAL READINESS PROGRAM FLYER